Kigo Reservations

Kigo Reservations can save you time, improve owner confidence and better control costs. Learn More

Learn More

Kigo Channel Manager

With Kigo Channel Manager Software, we provide a method through the madness, with strategic tools to help you get the most from each and every vacation rental property. Learn More

Master your channel marketing by setting up different configurations per channel, per unit.

Kigo Vacation Rental Channel Manager helps short-term rental managers increase brand exposure, maximize bookings and grow revenue.

Connected Channels

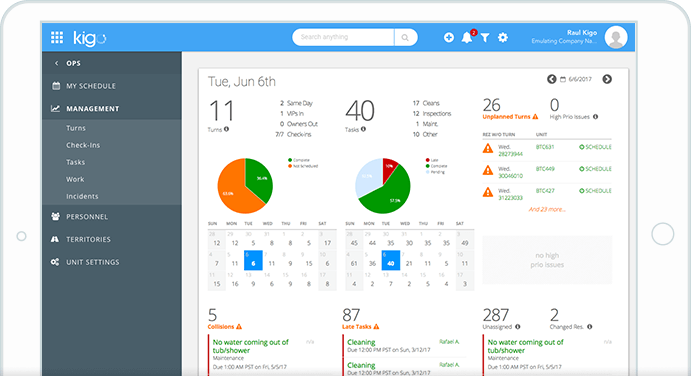

Kigo Operations Manager

Our Kigo Operations Manager is designed to organize all of your operations and labor resources, saving 20 hours a week. Learn More

Learn More

Kigo Guest Experience

Kigo Guest Experience puts the power in your guests hands, giving them answers when they need them most. Learn More

Learn More

Kigo Vacation Rental Websites

Drive bookings to your business with the ultimate digital storefront for any vacation rental business, a Kigo website package. Learn More

Learn More