PSD2: Strong Customer Authentication for Next Generation Payments

First off, what are SCA and PSD2?

In order to combat fraud, a new framework known as the Payment Services Directive, or PSD2, was introduced in Europe. The goal of this legislation is to introduce Strong Customer Authentication, or SCA, into the payments landscape. European banks are expected to begin requiring SCA on December 31st, 2020.

What is Kigo doing to address this?

Kigo is working very closely with our partners to ensure that we are completely compliant by the December 31st, 2020 due date.

To that end, Kigo will be updating our payment integrations over the course of this year.

But what does this mean for me as a Property Manager?

As a property manager, there is absolutely no action required on your part in order to remain compliant with this directive! Kigo is working with our payment gateway partners to make sure that everything is ready to go by the deadline.

In addition, as a property manager you can expect the following benefits:

- Improved fraud prevention

- Shifting of liability

- Providers who fail to authenticate a transaction appropriately will now be held liable for any resulting breaches, as opposed to the property manager

- Operating costs will lower as a result of less fraud and chargeback management

How will my guests be impacted?

For the most part, guests won’t experience any additional friction when trying to make a payment. This is because the “3DS2” method being implemented introduces a more user-friendly method of obtaining guest data automatically, without them having to navigate to a separate screen to provide it.

That being said, when a guest is making a payment online, there are times when the bank may challenge them to provide additional information in order to validate and authenticate the payment and mitigate high risk transactions. The principal tenets of the new directive require businesses to change the way they go about collecting payments, and entail the guest providing at least two of the following pieces of information:

Image Source: Stripe

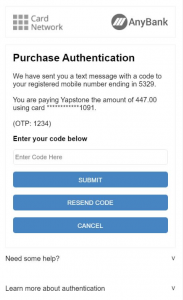

With the “3DS2” method mentioned above, this becomes seamless and that information is collected automatically. In the event a guest must manually verify, they will be presented with a new page from the bank for verification, similar to this example:

Will my business be impacted by the new laws?

You’ll be impacted by the SCA requirements if you meet both of the following criteria:

- You are processing credit cards that were issued in Europe

- Payments are being processed through a European Bank for the reservations that are being made. (i.e. you are a business operating out of the EU)

- Please Note: The following rules also apply to the United Kingdom and its respective financial institutions

- Note: The directive does not apply in the United States, and property managers operating outside of Europe will not be subject to these changes. US property managers accepting credit cards from European based guests are not subject to these directives. (EU çèEU only)

You can learn more about our payment processing solution here.